Health Insurance Access Related to the Maui Wildfires

If you have been affected by the Maui wildfires as an employer or an individual, you may be wondering whether your healthcare coverage has changed. Below is information on how to proceed to check on coverage and secure insurance if circumstances have changed.

For Employers

For businesses and employers affected by the Maui wildfires, commercial insurance companies (e.g., HMSA, Kaiser, HMAA and UHA) are working to ensure coverage through the end of September.

Because premiums are paid at the beginning of each month, coverage should not be affected for the month of August 2023.

If you are a business or employer, and are struggling to pay your premiums, it is important to reach out to your insurance company to get assistance. Commercial insurance companies will work with affected businesses and employers to defer premium payments for September 2023 if appropriate and necessary. This may mean setting up a payment plan or, an alternative arrangement.

For Individuals

If you are currently covered by an insurance plan provided by your employer, please contact your employer to determine whether they will be providing coverage through the end of September.

If you have lost your insurance coverage for any reason, you have several options to get covered:

- You can apply for Medicaid.

- You can apply for a different commercial plan through the insurance exchange at Healthcare.gov.

- You can apply for COBRA coverage.

Applying for Medicaid

Individuals can apply for Medicaid at any time through the MedQUEST program.. There are limitations on income and (in some cases) assets that may limit an individual’s eligibility for the program. Information on how to apply can be found here. Here is a direct link to the application.

Approvals are currently being expedited so that there is no disruption in coverage. In some cases, MedQUEST may need additional information—however, due to the emergency, MedQUEST will accept a self-attestation from an individual that the information provided is true and will provide applicants three (3) months to submit the necessary information.

If you are already enrolled in Medicaid, you may be aware that MedQUEST is in the process of determining whether current enrollees are still eligible for coverage under the program. That process has been paused for Maui County residents. If you are a Maui County resident currently enrolled in the Medicaid program, and you received a notice asking for renewal or redetermination, your due date for that information has been shifted to March 2024 to allow more time for submission of information.

More information on who can qualify based on income and assets is at the end of this document.

Applying for Private Insurance on the Exchange

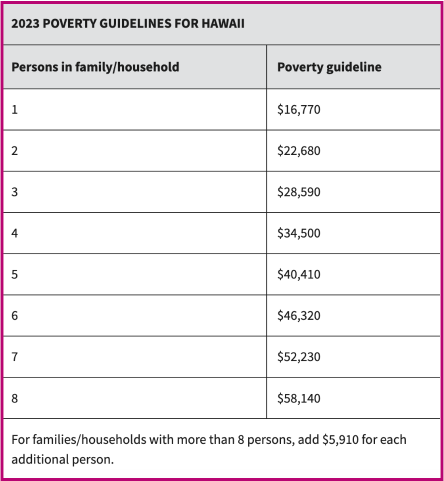

You can apply for private insurance from either Kaiser or HMSA on the insurance exchange at Healthcare.gov. Individuals who have a household income between 100-400 percent of the federal poverty level (FPL) can qualify for tax credits that will help to decrease (or, in some cases, cover entirely) the costs of monthly premiums.

Your monthly premium would be based on your income. You can find local help to sign up for a plan on the Healthcare.gov website.

Applying for COBRA

If you have lost your job, had your hours reduced, or experienced other qualifying events you could maintain your current health coverage through COBRA. While this is often used as a temporary bridge to maintain an individual’s exact same insurance plan, as long as your employer’s group coverage remains intact, you can stay on COBRA for a more extended period of time. You would have 60 days to enroll.

You can find more information about what COBRA coverage is and how you can qualify from the Department of Labor and Healthcare.gov.

This will likely be one of the most expensive options for individuals who have lost coverage. In some cases, the plan may require you to pay the entire group rate premium out of pocket plus a 2% administrative fee, so cost is an important consideration when exploring COBRA as a health coverage option.

Information on Income Requirements and the Federal Poverty Level (FPL)

Eligibility for Medicaid and tax credits under the exchange is dependent on income level and, in some cases for Medicaid, asset level. Below is information on qualifications.

People whose Medicaid eligibility is based primarily on their income will be eligible under the following Federal Poverty Level (FPL) thresholds:

- Children – up to 313% FPL

- Pregnant Women – up to 196% of the FPL

- Parent/Caretaker relatives – up to 105% of the FPL

- Adults under the age of 65 (not receiving Supplemental Security Income or Medicare)– up to 138% of the FPL

People who are 65 and over, or blind or disabled, may have eligibility determined using the following income and asset thresholds:

- Income up to 100% of the FPL and up to $2,000 in assets for a single person household or up to $3,000 for a household of two; or

- If income is greater than 100% of the FPL and assets up $2,000 for a single person household or up to $3,000 for a household of two, may be eligible for medical assistance under the Medically Needy Spenddown program, provided he or she has medical expenses greater than the determined spenddown amount.

The FPL levels for 2023 are below.